Rokel Commercial Bank (RCB) is reputably known for sound record of quality service to the nation after decades of existence and dominance in the country’s banking industry.

RCB, throughout its period of existence, has earned a reputation that has put the institution in a class of its own.

As it is the norm in the business world, the existence of any business institution is premised on profit maximisation so that it keeps running and serving the people effectively and efficiently.

RCB’s profit margin, over the years, has made it increasingly relevant to an economy that needs highly experienced and result-oriented stakeholders in the banking industry.

In 2017, RCB reported a profit of Le 62.7Bn for which the RCB Manager, Mr Dalton Gilpin and staff took credit. With the knowledge and experience gained at the Bank of Sierra Leone and abroad, the Managing Director assured RCB clientele and the entire country of his commitment to the maintenance of higher heights.

Chairman of RCB’s oversight committee for 2017, Mr Abu Bakarr Jalloh was highly impressed.

He was proud to say: “An unprecedented growth in terms of deposits as well as impressive performance in the bank’s business is being realised.”

Apart from the gains made in 2017, RCB also recorded huge profits in previous years.

RCB made a profit of Le1.03Bn in 2015 to the admiration of Sierra Leoneans. The profit trajectory of RCB was stoutly maintained to prevent a negative turning back.

In 2015, RCB’s profit increased to 1.5Bn which was a no mean feat for a bank that works hard to establish and maintain a permanent hegemony in a perfectly competitive industry.

The vast increase in profit is a true reflection of RCB’s marketing effort by growing the deposit base resulting into more profits from investment.

The profit highlights during recent years are in no way exhaustive as marked profits have been earned throughout RCB’s years of existence.

The profits got, over the years, in its business operations do not only go the bank’s coffers, but also shared to the country’s needy and less privileged.

As part of its strategy to consolidate quality education in Sierra Leone in line with government’s policy on education, RCB has spent millions of Leones through national and literary competition every year.

Investment in the education of the young is one that has no equal anywhere in the world.

Banking Strategies

The respect the bank has been comfortably enjoying in the world of banking cannot be divorced from the banking strategies it vigorously pursues in the interest of its clientele and the country.

In 28th July 2019, RCB responded to the call of World Bank to deepen financial inclusion in Sierra Leone, a country confronted by a number of banking constraints.

As a glowing testimony of the response to the call, RCB launched the innovative digital banking product commonly referred to as the Rokel ‘Simkopor’ product at their Wilkinson Road Branch in Freetown.

The ‘Simkopor’ launching ceremony thrilled top government functionaries, key stakeholders in the banking industry, managing directors of sister banks and RCB clientele among others.

To them, the launch symbolises a new dawn in the banking industry as the mobile app has taken banking to the doorsteps of households.

Banking transactions of various forms can be conveniently done without coming to the bank’s premises.

The ‘Simkopor’ can be used by RCB clients to do withdrawals, make deposits, payment for goods and services, transfers from one account to another within RCB and from RCB to any other bank.

The product also enables one to make payments through e-cheques to non-account holders or where the recipient of the account is unknown. The benefits also include encashing cheques from RCB at ATMS points among others.

The rolling out of the banking software, Rokel ‘Simkopor’ has seen Sierra Leoneans in remote areas especially Bonthe Island accessing banking services.

For the first time in over fifty years, government workers in the Island were paid their monthly salaries through the strategy. It saved them from the expensive and hazardous journeys to district headquarters to enjoy banking services.

The ‘Simkopor’ is literally a bank in the hands of the clientele with user-friendly but highly scrutinised protocols.

The product has provided jobs for hundreds of citizens recruited and trained as agents in different parts of the country.

A RCB survey whose result indicated low level of education, long queues at the banks, bureaucratic nature of traditional banking, and low rate of people accessing financial services informed the launching of the ‘Simkopor.’

The survey resonates with a 2017 World Bank Survey (WBS) which placed the overall Sierra Leone’s banking population at 16 to 17%.

The WBS also showed that access to banking and financial services remained inaccessible to over 70% of Sierra Leoneans and 90 chiefdoms in the country.

RCB’s universal banking system keeps providing the basis for the operations of 12 branches across the country. Arrangements are constantly in place to upgrade their systems with a view to fully provide them with modern banking facilities to match up with existing competition in the sector.

RCB is a financial institution whose zeal for compliance with ethics could not be whittled down by the chase for the luxuries of business. In Its day-to-day services to a diverse clientele, RCB has always conformed to Borrowers and Lenders’ Act 2014 and the Borrowers and Lenders’ Regulations 2016.

Financial inclusion is also another strategy that is equally considered to be part of RCB flurry of strategies to take the bank forward.

The financial inclusion is a move on the part of RCB to ensure that no Sierra Leonean is left behind in the enjoyment of banking services including savings, payment and insurance investment among others.

The sustained implementation of this strategy has made Sierra Leoneans in the least remote communities to enjoy banking services.

Loans with low interest to customers especially civil servants, Pay Advance Salary Schemes are also key strategies not lost sight of in RCB business operations.

The National Cleaning Saturday has also attracted funding from RCB to ensure a safe, clean and healthy environment. The bank has not spared huge millions of Leones in the provision of logistical and material support to a cleaning exercise observed during the first Saturday of every month.

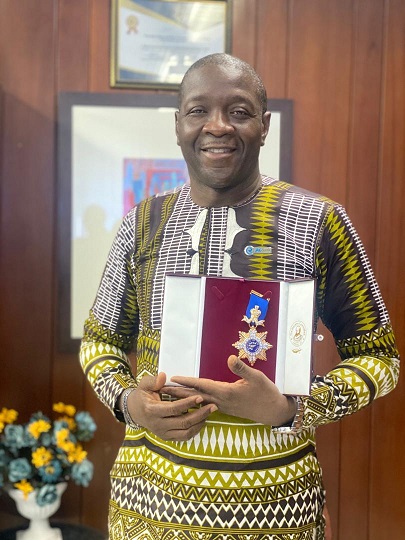

Awards and Prospects

Resounding successes in the profits recorded through the implementation of strategies has led to unimaginable awards to RCB and a prospect to growth and prosperity.

In 2018, RCB won the Environmental Care Awards by Shout Climate Change Africa and Environment Protection Agency.

The bank in the same year won the financial institution of the year, Nigeria Business Awards, African leadership awards and Medal of Honour in Business as well as certificates of appreciation offered by reputable institutions.

As RCB continues to flourish in the banking industry, more awards are expected owing to the bank’s prospects for prosperity and growth.