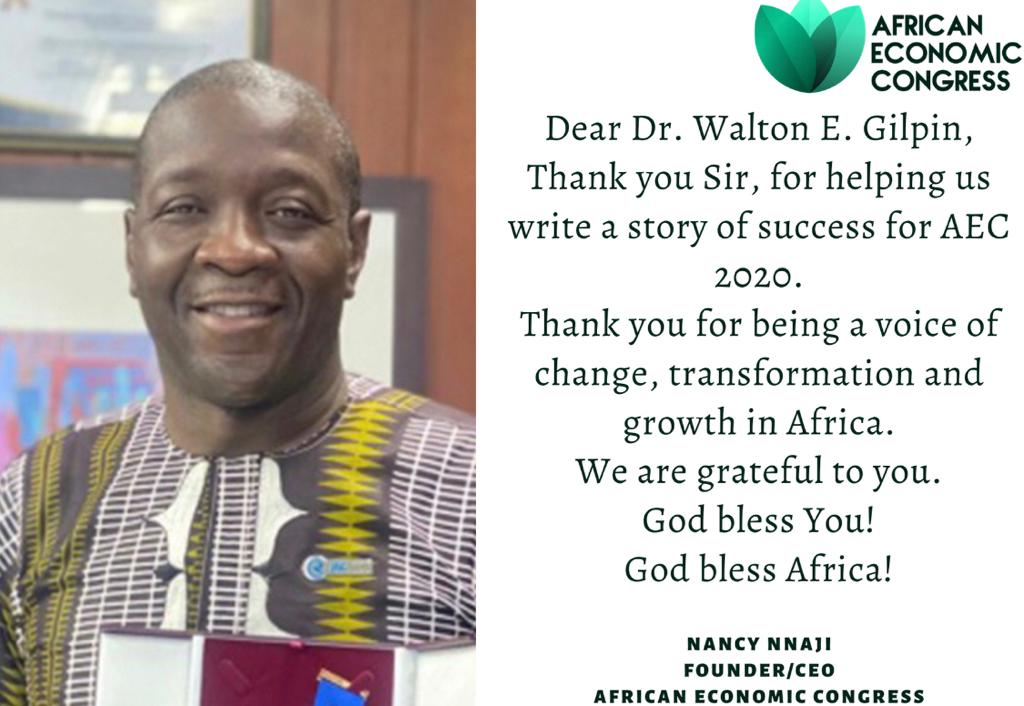

Managing Director of Rokel Commercial Bank (RCB) Dr Dalton E. Gilpin has been honoured by the African Economic Congress (AEC) for his determination in ensuring economic transformation and growth not only for Sierra Leone but also for Africa. AEC is continental organisation that draws its membership from prominent and highly talented personalities in Africa.

In an AEC congratulatory document , Dr Gilpin was thanked and commended for helping the organisation writes a story of economic success for Africa.

“Thank you for helping us write a story of success for AEC, 2020…and for being a voice of change, transformation and growth in Africa,” the document reads in part. The congratulatory message for the Rokel Bank Manager came after the organisation held its annual congress meeting between 2-4th November, this year in the West African Country of Nigeria.

The meeting was held under the theme: ‘Post Covid-19, Africa in the economic order.’ The organisers of the event say they are most grateful to the Dr Gilpin for his valuable contributions to the economic growth and development of the continent. The meeting brought together visionary and innovative leaders from around the world to communicate with each other, focus on new ideas that will impact the changing economy around them.

AEC has its main objective of achieving a more sustainable Africa and inclusive feature. In its quest for the realisation of such goal, the organisation works with highly talented and credible personalities who have immensely contributed to the growth and development of their country’s economies.

Economic growth in different countries in Africa has a cumulative effect of making African continent proud. Dr Gilpin’s contribution to the banking industry has put him in a class of his own evidenced by a countless number of awards he has won.

His AEC honour shows that his contribution to economic development has transcended the borders of Sierra Leone. Since Dr Gilpin became RCB Manager, he has carved a niche for delivering sound and quality banking services to the people of Sierra Leone. Little wonder that RCB is now a reckonable and dominant force in the banking industry.

The reputation and status RCB has earned since Dr Gilpin appeared on the stage of management is second to none. The main business objective of profit maximization and the protection of the diverse interests of RCB’s clientele has been Dr Gilpin’s focus over the years.

Strategies pursued by Dr Gilpin for the purpose of sound banking in Sierra Leone has brought him international recognition hardly enjoyed by any banker. RCB’s profit margin over the years has made it increasingly relevant to an economy that needs highly experienced and result-oriented stakeholders in the banking industry.

In 2017 the bank reported a profit Le62.7Bn for which Dr Gilpin and staff of the bank take credit.

With the knowledge and experience gained at the Bank of Sierrra Leone and abroad, the Managing Director assured RCB clientele and the entire country of his commitment to the attainment of higher heights in the banking world.

Dr Gilpin has also won internal recognition for his prudent strategies which has gone a long way in transforming the country’s economy.

Chairman of RCB’s oversight committee for 2017, Mr Abu Bakarr Jalloh was highly impressed. He was proud to say: “An unprecedented growth in terms of deposits as well as impressive performance in the bank’s business is being realised.”

Apart from the banking gains made in 2017, RCB also recorded huge profits in previous years. It is on record that RCB earned a profit of Le1.3Bn in 2017 to the admiration of a great many Sierra Leoneans. RCB’s profit trajectory was stoutly maintained to prevent a negative turning back.

In 2017, RCB’s profit increased to 1.5Bn which was a no mean feat for a bank that works hard to establish and maintain a permanent hegemony in a perfectly competitive industry. Africa, no doubt, needs the likes of Dr Gilpin who continues to take the lead role in Africa’s banking industry.

Like Ebola Virus, Covid-19 attacked the economic pillars of African states considering its devastating effect on small and large-scale businesses. Corona Virus seems be more potent in its destructive nature to African economies.

The secret of its destruction lies in the dangers it causes to European countries including the United States on which African countries, to great extent, rely for economic survival, growth and development. Economic trends have shown that the Coronavirus is not only a public health emergency but also a major threat to the world’s economy.

Records seen by this press show that the virus has caused global market to crash, raising fears of a recession. It is also shown that the financial impact of the Coronavirus pandemic is already seen by global financiers.

The Global financial watchdog, the International Monetary Fund predicts that Africa’s economy will contract by 1-5 percentage points in 2020, a loss of around USD200Bn in income for the region.

What started as a single Covid-19 case in November, 2019 rapidly spread across the whole world within the first quarter of 2020 presenting one of the most serious global health crisis with high socio-economic cost.

While its impact on the world’s health systems including fatalities continue to rise, the economic toll records say is still unclear as the world faces threats of an “unprecedented global recession.”

It is estimated that Covid-19 will drag African economies into a fall of about 14 per cent in GDP with smaller economies especially in Africa facing a contraction of up to 78 per cent. The contraction is mainly a result of export adjustments affecting primary commodity exporters, and associated losses of tax revenue which considerably reduce capacities of governments to extend public services necessary to respond to the crisis.

In Africa’s economic recovery strategies, it is expected that Dr Gilpin will play an important role. The brilliant and rich experience he has acquired over the years in the banking industry will make Africa great again.