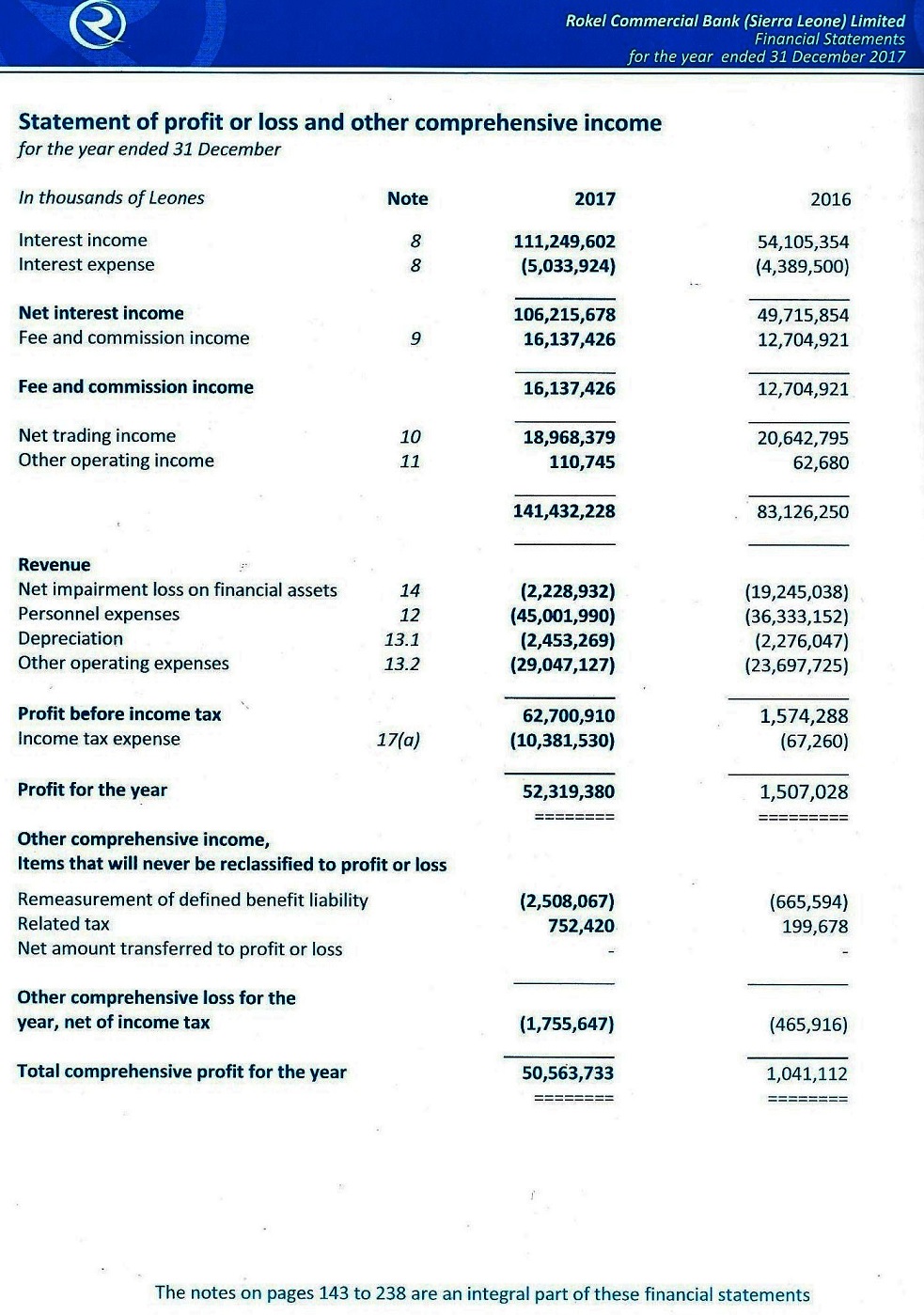

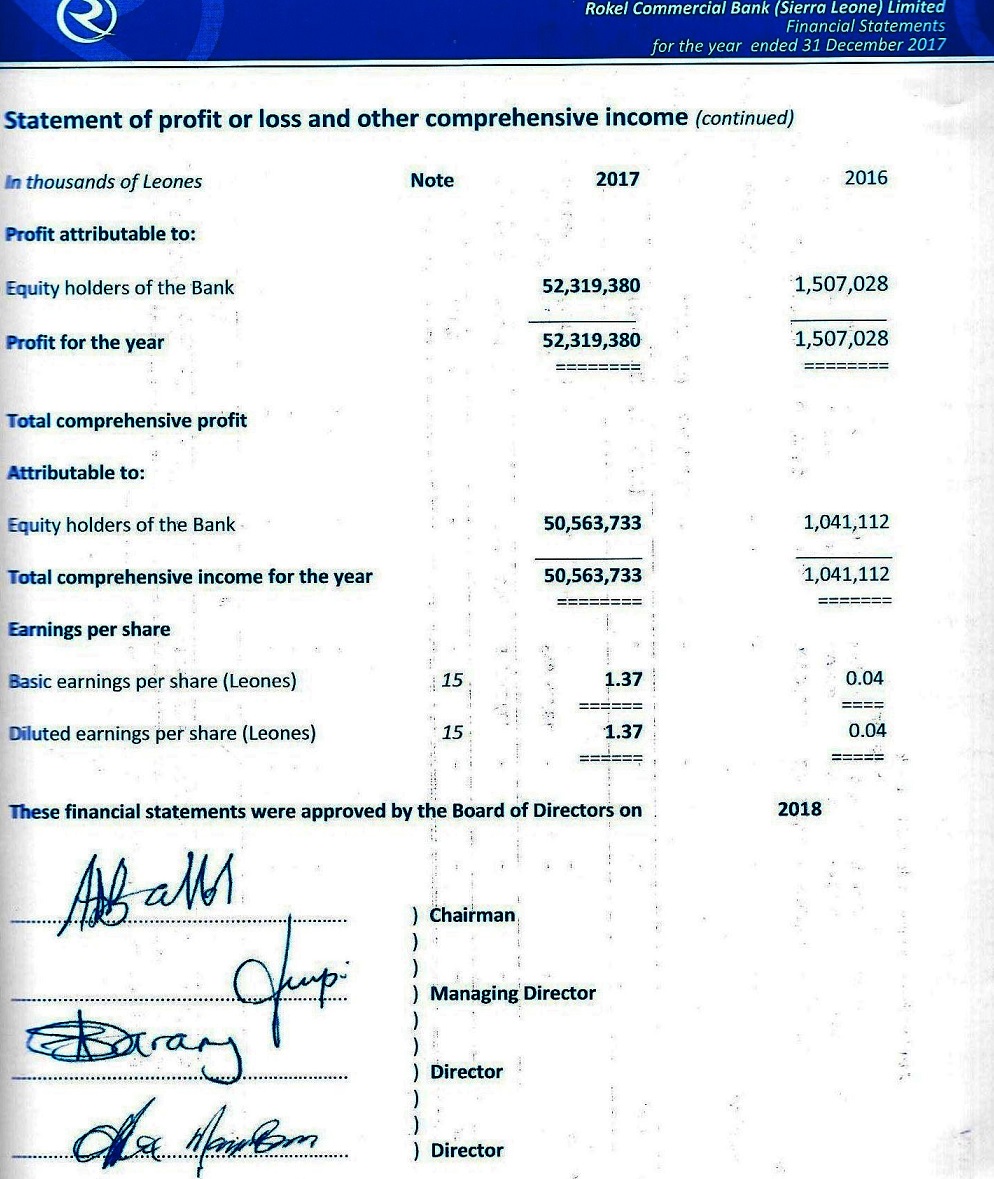

Rokel Commercial has reported a profit of sixty two billion leones (Le62.7 Bn) after tax for 2017. This disclosure was made yesterday at the Cathedral Hall in Freetown, where the Annual General Meeting of the Bank’s shareholders was held.

Delivering a statement to the shareholders, Mr. Dalton Gilpin, Managing Director Rokel Commercial Bank, told shareholders and other interested parties, including customers and the press during the Annual General Meeting, that the Bank is continuously striving to maintain higher heights within the industry. He gave a brief background of his history with the sector, including his days at the Bank of Sierra Leone and recalled his coming back home to serve in the sector.

The Managing Director praised the resilience of his staff and his newly constituted Board of Directors, while he also showered praises on Mr. Sanpha Koroma, the owner of Union Trust Bank. He noted that he has carefully listened to his remarks at the Annual General Meeting and has taken into consideration all what he said.

He noted that he has always conferred with him since he came back home, as he has admired his experience and achievements so far in the country’s banking sector.

He noted that the strength of the Bank is in ICT, adding that they are now more poised than ever before to strategize and contribute to the growth of the country and open up the space to Sierra Leone to access more financial services and access points.

Mr. Walton Gilpin was appointed Managing Director of Rokel Commercial Bank in July,2017 after he returned home from overseas. Within his short spell, as Manager, Mr. Walton Gilpin has been able to inject new blood into the staff of the Bank and the bank has continuously grown from strength to strength.

His priority has been to complement and support the Bank of Sierra Leone and the New Direction’s financial inclusion programme, using the available IT solutions. His recent introduction of the Rokel Simkorpor and many other mobile banking services has made the bank the leading provider of financial services and access points.

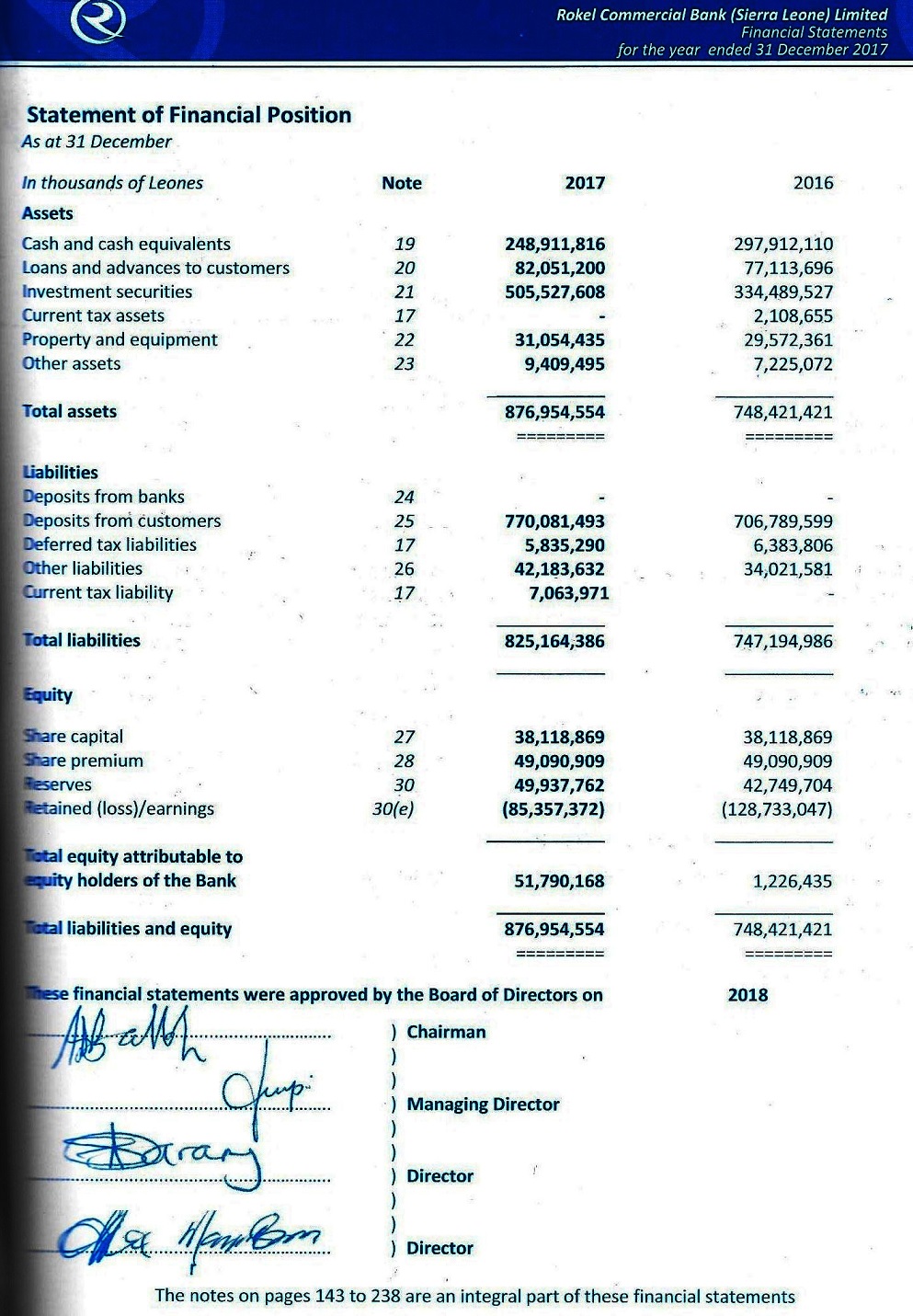

The 2017 profit of 67.2 billion was achieved after the Bank went into a loss of Le 99bn in 2013 and such as profit has not been recorded in the last eighteen years by the Bank.

Chairman of the Bank’s oversight Committee for 2017, Mr. Abu Bakarr Jalloh, told shareholders that the year under review has witnessed an unprecedented growth in terms of deposits as well as impressive performance in the Bank’s business, after it reported a loss of Le 99 Bn in 2013.

The Chairman attributed it to the appointment of a new MD in July,2017 in the person of Mr. Walton Gilpin, who, according to him, has a wealth of knowledge and experience in banking and other areas.

He disclosed that the Bank, in its efforts to make banking services accessible to all, has developed a wide range of new products, while also adopting strategies that has made the bank great again.

The Chairman furthered that, this is the first time in eighteen years that the bank is recording such huge profit.

“The vast increase in profit reflects our marketing efforts in growing our deposit base thereby leading to more interest from investment in government securities,” the Chairman noted.

He continued that the net trading income of Le19bn decreased by 2bn in 2016, representing the significant drop in trading activities due to scarcity in foreign currencies during 2017.

On human resource, the Chairman noted that “this remains the most valued asset of the Bank and, as at December 2017, the total number of staff was three hundred and three, 100 new members joined the Bank, including the Managing Director, whilst eleven members of staff severed relationship with the Bank for various reasons.

He highlighted that the Bank’s Universal Banking System (UNIVBANK) keeps providing the basis for the operations of the 12 branches across the country. Arrangements are in place, according to him, to upgrade their systems with a view to fully provide them with modern banking facilities to match up with existing competition in the sector.

The Oversight Chairman concluded by thanking the shareholders, esteemed customers, members of staff, the regulatory and supervising authorities (the Bank of Sierra Leone and the National Commission for Privatization) for their different contributions to the growth and stability of the bank.

The Annual General report of the Directors of Rokel Commercial Bank comprises of the statement of the financial position of the bank for the year under review. He said such a position includes statements of profits and loss and other comprehensive income, changes in equity and cash flows for the year under review. This is in direct compliance with the International Financial Reporting Standards as required by the Companies Act of Sierra Leone and the Banking Regulations of Sierra Leone.