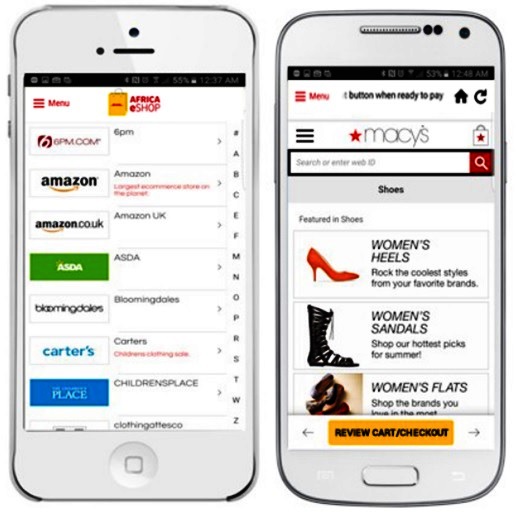

DHL is launching an e-commerce app, called DHL Africa eShop, for global retailers to sell goods to Africa’s consumer markets.

The platform goes live today and brings more than 200 U.S. and U.K. retailers — from Neiman Marcus to Carters — online in 11 African markets: South Africa, Nigeria, Kenya, Mauritius, Ghana, Senegal, Rwanda, Malawi, Botswana, Sierra Leone and Uganda.

DHL Africa eShop will operate using startup Mall for Africa.com’s white label service, Link Commerce. Payment methods will include local fintech options, such as Nigeria’s Paga and Kenya’s M-Pesa.

The announcement comes as e-commerce in Africa has seen some ups and downs — with online sales startup Jumia announcing an IPO, while several Africa digital retail ventures have recently faltered.

DHL Africa eShop takes advantage of the shipping giant’s existing delivery structure on the continent, able to get goods to doorsteps near and far through its DHL Express shipping, tracking and courier service.

DHL’s partner for the new app, MallforAfrica, has experience collaborating with DHL and a number of big-name retailers, including Macy’s and Best Buy. Backed by Helios Investment Partners, MFA was founded in 2011 to solve challenges global consumer goods companies face when entering Africa.

MallforAfrica’s payment and delivery system serves as a digital broker and logistics manager for U.S. retailers that come online with the startup to sell their goods to African consumers.

DHL has been a MallforAfrica logistics partner since 2015, and in 2018, the two teamed up to launch MarketPlaceAfrica.com — an e-commerce site for select African artisans to sell their goods in any of DHL’s 220 delivery countries.

For DHL Africa eShop, MallforAfrica’s Link Commerce service will facilitate local payments, procurement and delivery, MallforAfrica CEO Chris Folayan told TechCrunch.

“That’s what our service does. It takes care of that whole ecosystem to enable global e-commerce to exist, no matter what country you’re in,” he said.

In a statement, DHL Express CEO for Sub-Saharan Africa referred to the DHL Africa eShop app as something that “provides convenience, speed, and access to connect African consumers with exciting brands.” The DHL Africa app is also intended to fill a commercial void, according to DHL, as many U.S. and U.K. retailers do not ship to Africa.

E-commerce ventures, particularly in Nigeria, have captured the attention of VC investors looking to tap into Africa’s growing consumer markets. McKinsey & Company projects consumer spending on the continent to reach $2.1 trillion by 2025, with African e-commerce accounting for up to 10 percent of retail sales.

As mentioned, Africa’s e-commerce startup landscape has seen its own ups and downs. Pan-African e-commerce startup Jumia’s recent IPO filing on the NYSE is a first for any startup from Africa. MallforAfrica has also continued to expand into new countries, now operating in 17, with partners, such as DHL.

On the flip side, the distressed acquisition of Nigerian e-commerce hopeful Konga.com, backed by roughly $100 million in VC, created losses for investors. And in late 2018, Nigerian online sales platform DealDey shut down.

On a B2C level, DHL Africa eShop brings distinct advantages on a transaction cost basis (that is the cost of delivery) given it is connected to one of the world’s logistics masters, DHL.

Another component of DHL and MallforAfrica’s partnership is the market for offering e-commerce fulfillment services through MallforAfrica’s white label Link Commerce service.

This could put the duo on a footing to compete with (or work with) big e-commerce names entering Africa and adds another layer of competition with Jumia, which offers its own fulfillment services vertical in Africa.

As for the big global names, Alibaba has talked about Africa expansion, but for the moment has not entered in full.

Amazon offers limited e-commerce sales on the continent, but more notably, has started offering AWS services in Africa.

To watch is how DHL’s new Africa eShop business factors into the continent’s online-sales landscape. It could certainly serve as a new player in African e-commerce phase 2.0, now that the sector has shaken out some failures, produced an IPO and drawn the attention of big global names.

Home Breaking News Front Page News For Global Retailers To Sell To Africa… DHL Launches Africa eShop App